north carolina estate tax return

More on Money. NC 27253 Phone 336570-6565.

State Employees Credit Union Tax Refund Information

18970732316 for a tax levy of 109080596.

. Catawba Countys Tax Collection Rate - Fiscal Year 2021. North Carolina property tax rates range from a low of 042 percent in Watauga County to a high of 122 percent in Durham County. Alternative energy generating devices and even business real estate improvements.

Apart from making scheduled tax payments businesses making payments on a semiweekly schedule also must file quarterly withholding tax returns. Tax changes in budget legislation. The tax rate gradually will be reduced to 0 by 2030.

North Carolina has not always had a flat income tax rate though. An Income Tax Return for Estates and Trusts Form D-407 must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income from North Carolina sources or income which was for the benefit of a North Carolina resident and the estate is required to file a federal return for estates. If a landlord in North Carolina does not return the security deposit within 30 days from the move out date the landlord loses the right to make any deductions and may be liable for damages costs of suit and attorneys fees.

Mortgage-Type Tax Foreclosures in North Carolina. The most drastic change to the states tax regime is a phase out of the corporate income tax. Your North Carolina State Individual Tax Return for Tax Year 2021 January 1 - Dec.

Our North Carolina real estate exam prep comes with over 1000 NC real estate exam prep questions and. North Carolina already had one of the lowest corporate income tax rates in the nation at 25 in 2020. The North Carolina State Tax calculator is updated to include.

If youve filed your state tax return in North Carolina you may be curious about when you can expect to receive your tax refund. Form 8971 Information Regarding Beneficiaries Acquiring Property From a Decedent. This return must be.

Heres a look at the four stages of return processing for the North Carolina Department of Revenue NCDOR. North Carolinas Southeast is a publicprivate economic development organization which provides free confidential services to business owners site consultants and industrial real estate executives around the world. Department of Insurance.

Catawba Countys Tax Base - Fiscal Year 2021. There are a number of differences in the way that items of income and deduction are treated on federal and North Carolina income tax returns. Calculate your total tax due using the NC tax calculator update to include the 202223 tax brackets.

North Carolina Estate and Inheritance Taxes. Effective for tax years beginning on or after January 1 2023 applicable to the calculation of franchise tax reported on the 2022 return the franchise tax will be determined solely by measuring the net worth of a corporation. Estate certain trusts as described in IRC section 1361c.

However for Medicaid eligibility there are many assets that are considered. North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. Birth Death and Marriage Records.

Providing services related to wills trusts probate succession planning guardianship estate litigation and planning. Prescription Drugs are exempt from the North Carolina sales tax. North Carolina Department of Insurance Raleigh NC Website.

Form 706 Federal Estate Tax Return. The answer wont be the same for everyone because processing time can change based on when and how you filed. North Carolina doesnt charge an estate tax or an inheritance tax at the state level.

Countable assets include cash stocks bonds investments IRAs credit union savings checking accounts and real estate in which one does not reside. Security Deposits and Tax Filing in North Carolina. Let us connect you to the assets that are critical to your companys success and growth.

North Carolina is currently delayed in. NORTH CAROLINAS SOUTHEAST BUSINESS CLIMATE. In the first year the property generated an annual cash flow of 75000 but she sustains a 25000 tax loss that she can apply against the income of a very successful car wash that she owns.

North Carolina Estate Planning Law Firm. 202223 North Carolina State Tax Refund Calculator. 6 Things Every Homeowner Should Know About Property Taxes.

With this kind of tax foreclosure the tax collector files a lawsuit against you the homeowner in court. Read North Carolina Medicaid eligibility requirements for long term care for seniors including the income. By The AARP Bulletin MAR 1 2022 An AARP study finds that 77 percent of Americans 50 and older want to age in place and home became central to peoples lives during the pandemic.

North Carolina is facing a retirement savings crisis that will leave far too many residents barely able to afford their basic needs in their later years. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75.

Each state has its own laws and regulations for securities brokers and securities - including stocks mutual funds commodities real estate etc. About Death Records in North Carolina. 31 2021 can be prepared online via eFile along with a Federal or IRS Individual Tax Return or you can learn how to complete and file only a NC state returnThe latest deadline for e-filing NC State Tax Returns is April 18 2022.

Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund. The returns reconcile the tax paid for the quarter with the tax withheld for the quarter. Bonus depreciation generally provided for the immediate expensing federal of 50 of qualifying new capital equipment.

The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive income tax system with rates ranging from 6 to 775. If you need to file this return use Form NC-5Q Quarterly Income Tax Withholding Return. Form 1041 Income Tax Return for Estates.

The phase out will begin in 2025 with the tax rate decreasing to 225. Search Alamance County recorded document index including real estate finance birth death and marriage records. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

When the tax collector files the foreclosure action with the court youll receive a summons and a copy of the complaint the lawsuit. Tenants and real estate investors easier by giving them. View information about obtaining Alexander County birth death marriage.

Alexander County Contact Info.

Irs Mailing Address Where To Mail Irs Payments File

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Tax Administration Duplin County Nc Duplin County Nc

How To File Income Tax Returns For An Estate 14 Steps

How To File Taxes For Free In 2022 Money

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

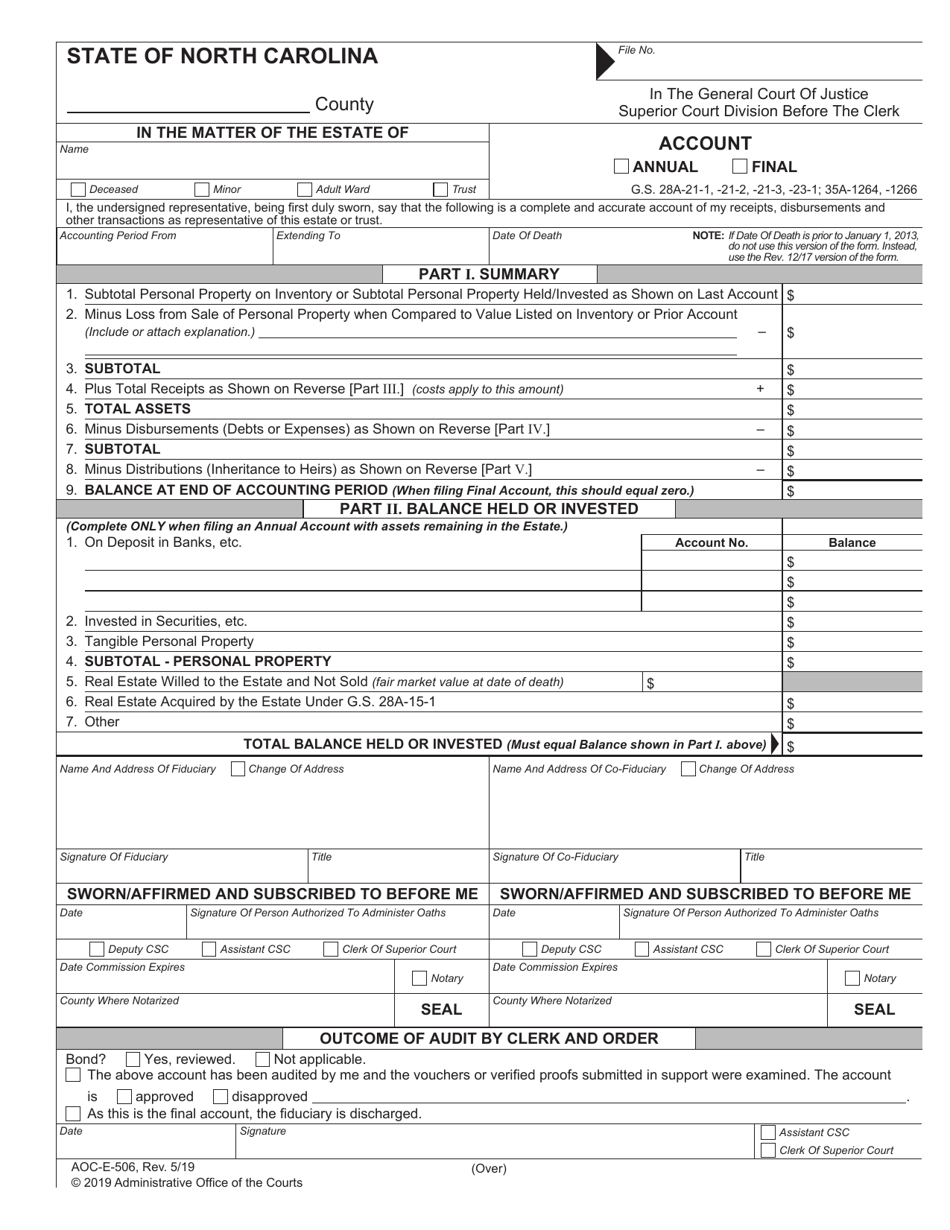

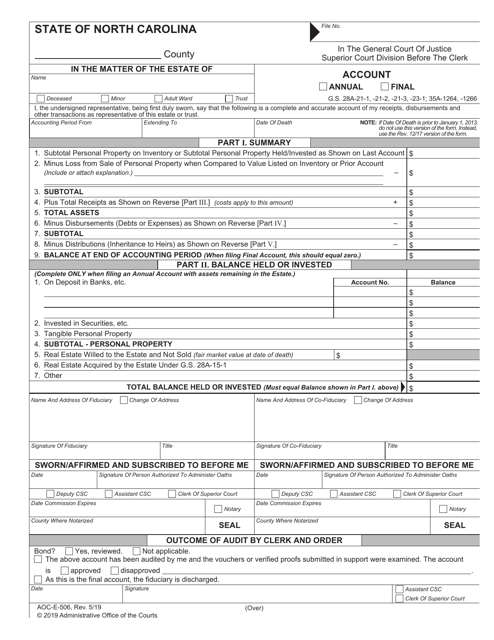

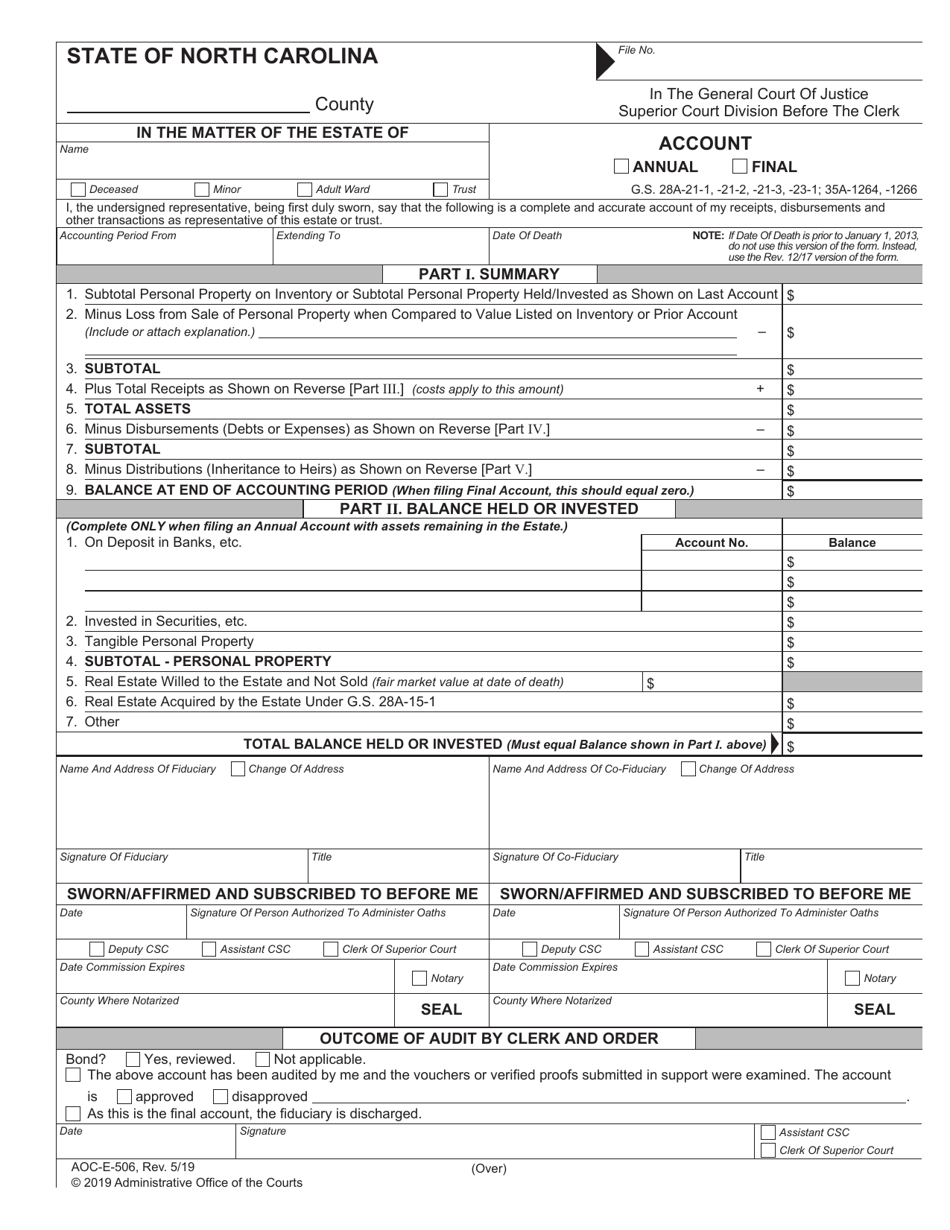

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Income 2021 2022 Nc Forms Refund Status

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Tax Administration Duplin County Nc Duplin County Nc

North Carolina State Taxes 2022 Tax Season Forbes Advisor

How Do State Estate And Inheritance Taxes Work Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pin By Reg Davies On Taxes Charlotte Nc Filing Taxes Identity Theft Tax Return

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller